# Welcome to raj teachers Helpline.

# Welcome to raj teachers Helpline. # इस वीडियो में बताया गया है:-

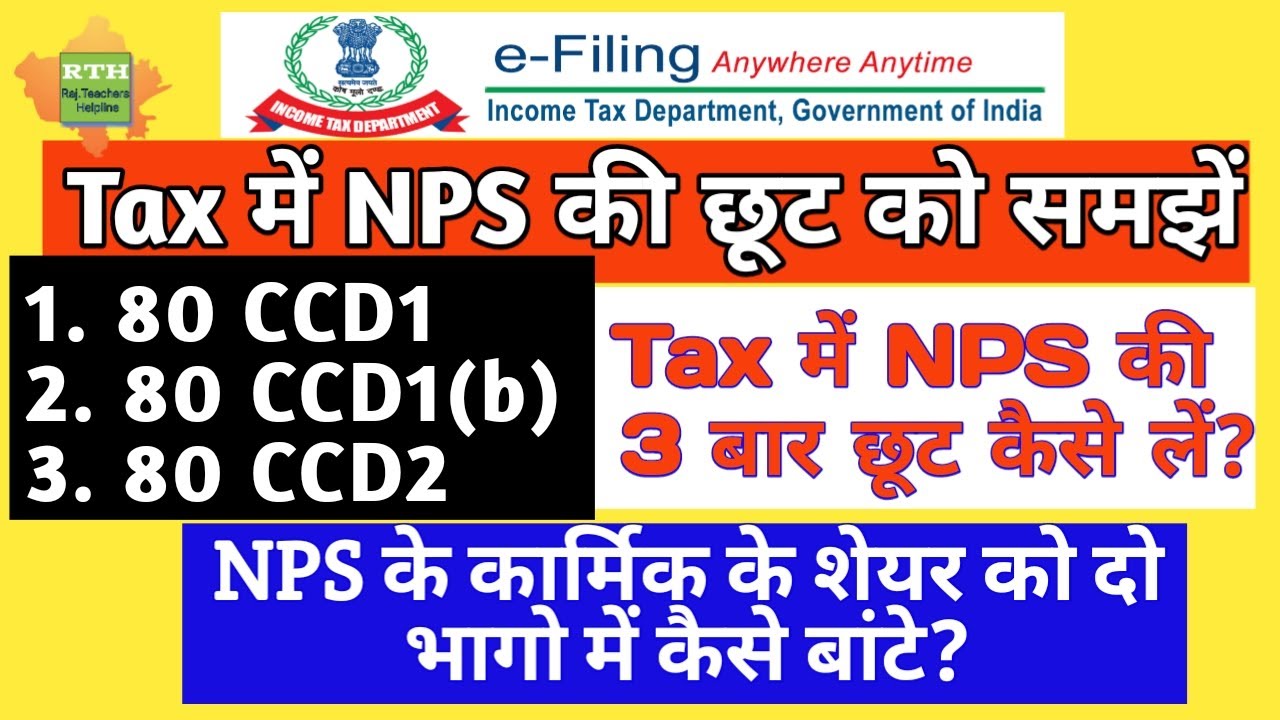

1. NPS Tax Benefit - Sec 80C and Additional Tax Rebate

2. Difference between u/s 80CCD(1), 80CCD(1b), 80CCD(2) || इनमें क्या अन्तर है?

3. How to get Deduction u/s 80CCD1(B) - Clarification for income tax calculation

4. How to get maximum Tax Benefit of NPS ||

5. National Pension Scheme India | Get Rs. 50,000/- Tax Exemption in NPS

# Income Tax Related other Videos available on our Channel;-

1. HRA क्या है और कैसे calculate करें?

2. HRA Exemption related Doubts | HRA की छूट सम्बन्धी प्रश्नों के जवाब|

3. How to Save Income Tax |Tax Saving Tips & Investments - Section 80C Schemes in 2019

4. what is Tax Rebate u/s 87A FY 2019-20| with Examples||

5. स्टेंडर्ड डिडक्शन की पूरी जानकारी|

6. फॉर्म 16 के बारे में सम्पूर्ण जानकारी।

7. INCOME TAX CALCULATION 2019||Slab Rates||REBATE||Tax Rebate AY 2020-21|| FY 2019-20 EXPLAINED|

:::: Channel Details:::::

# Raj teachers helpline

# be my facebook friend:- www.facebook.com/rajteacherhelpline

# like our Facebook page:-

# Join our facebook Group:

# please join us on telegram:-

Follow us on Instagram:-

# please follow us on Twitter:-

# email us:-

rajteacherhelpline@gmail.com

# raj teachers helpline

# Thanks for watching the video.

#npsdeduction#80ccd1#80ccd1b#80ccd2

0 Comments